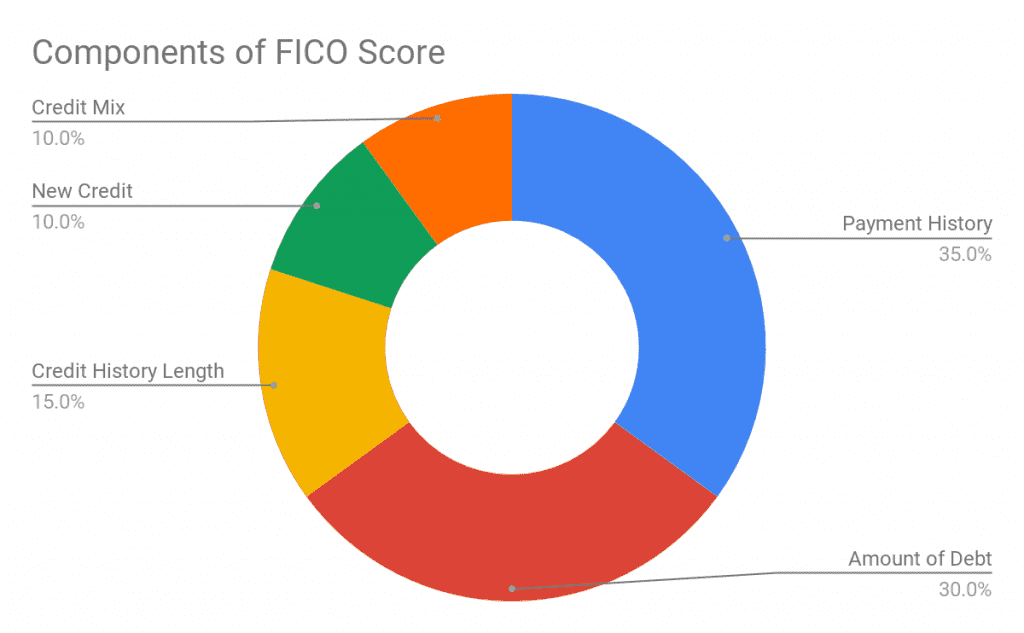

This means if you regularly make your payments on time, it will make a big contribution towards you having a better credit score.Īmounts owed makes up the second highest proportion of your credit score at 30%. FICO - What’s in your credit score? Your payment history shows lenders how risky it is to extend credit to you, and how likely you are to make your payments on time. The key piece of data that affects your credit score the most is your payment history, with this making up 35% of your overall score. Below you can see the breakdown of credit data categories and how FICO uses them to calculate your score: There are some key pieces of financial data that affect your credit score, but they don’t all have an equal impact. How much do different factors impact credit scores? If you manage to achieve a perfect credit score of 850, it may not stay that way for long. It’s important to bear in mind that an 850 credit score can be elusive, and credit scores change all the time depending on people’s financial habits, debt, payment history and applying for new loans. Some things may seem small, but they all contribute to your score. There are many more tactics you can apply to build credit and increase your score over time. Be careful when applying for new credit and make sure you build up your score before applying for more. Applying for credit carefully - Opening a lot of credit accounts in a short period of time or having lots of hard credit checks on your file can signify risk and lower your score.

A good mixture of credit shows that creditors trust you with the money they lend to you. Have a variety of credit accounts - People with the highest credit scores typically have a range of credit types including auto loans, credit cards, and mortgages.Maintain low balances on your credit accounts - Consistently high balances on your credit accounts can lower your score.Keeping credit use to a minimum - According to FICO, people with the highest credit scores only use around 7% of the credit that’s available to them.Make payments on time - Your payment history makes up the largest proportion of your credit score, meaning people who always pay on time have better scores.If you want to get a perfect credit score, consider practicing these: with credit scores of 800 or more typically have similar habits when it comes to their finances. Research from FICO Traits of the 800 FICO score holder showed that consumers in the U.S. How many people have a perfect credit score.What might stop you from achieving a perfect credit score.What are the differences between an ‘exceptional’ credit score and an 850 credit score?.How long does it take to improve your credit score?.

The highest credit score possible is 850. Data & Guides Credit Score Highest Credit Score

0 kommentar(er)

0 kommentar(er)